For the "average" homeowner with an property assessment of $350,000..

- The average tax increase will be $532/yr (mil rate increase = $1.52/1000) for the first 10 years (FY14 - FY23) after new high school is opened.

This compares to the $450/yr for 25 years (duration of school bond) figure that was presented at the 2/11/10 forum. - To calculate your average property tax increase for each of the first 10 years...

Multiple the mil rate increase x property assessment (1000’s)

example: $275,000.... 275 x $1.52 = $418/year - Click here to look up your current FY10 property assessment so that you can calculate your increase in future property taxes.

_____________________________________________

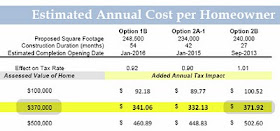

The public forum last September 30 provided an estimate of taxpayer costs as shown in the slide below…

The estimated tax increase was ~ $1.00/ $1000 (mil rate increase) of property assessment or ~$372 for an average $370,000 home.

The estimated tax increase was ~ $1.00/ $1000 (mil rate increase) of property assessment or ~$372 for an average $370,000 home.

However, at the latest School Building forum on February 11, the average taxpayer annual increase presented appeared to increase signficantly even though the town’s share of the project cost had shown only a small increase ($44M --> $46 million, + 4.5%).

FY11: $11; FY12: $65; FY13: $150; FY14: $580;

FY15: $567; FY16: $557; FY17: $546

Note 2: Because of lower property values for the current FY10, the average home assessment is now $350K (vs. $370K). The average annual tax increase for a typical $350,000 home over 25 years is estimated to be ~$450/year which translates to a mil rate of $1.28/ $1000.

At this point I was confused and had a couple of questions….

1. Did the average taxpayer cost of the project increase by 22% from Sept 30 to Feb 11 ($370 --> $450)?

2. Why was the average taxpayer cost for the first four years after completion of the project now $563 or $1.61/$1000? Was that a 52% increase ($370 --> $563) from the Sept 30 estimate?

I asked Paul Pasterczyk, Longmeadow’s Finance Director and a member of the School Building Committee and Christine Swanson/ SBC- co-chair for some clarification.

Here is what I found out…

1. The September 30 forum number was miscalculated and wrong!

2. The latest tax increase estimates which varied each year (higher beginning in FY2014 and lower at the end- FY2038) were based upon a fixed principal repayment bond repayment scenario vs. a constant debt service bond scenario. It should be noted that the quoted $450 average tax increase does not occur until FY2026!

To further understand this numbers, I calculated the year by year the tax increase for the two bonding scenarios and the results are shown below.

[click to enlarge spreadsheet]

For this first bond scenario the average tax increase for the first 10 years is $532.

[click to enlarge spreadsheet]

The second spreadsheet shows a constant debt service or tax increase of $469/year (mil rate increase = 1.34) for property owners.

Total increased tax payments by the "average" taxpayer over the term of the 25 year bond ranged from $11,250 (scenario #1) to $11,729 (scenario #2).

While I do not want to handcuff our bonding process, it would seem to me that the second bond scenario that provides for lower taxes in the first 10 years would be the preferred option for taxpayers.

I am interested in accurate estimates of the cost for our new high school. I would also ask the School Building Committee to present the taxpayer information in a more upfront manner. Quoting the FY11 --> FY13 tax increases as part of the tax increase picture is OK as long as we don't use it to minimize the cost that we will incur for many years to come.

By the way.... let's not forget the $750,000 that we have spent for the current planning/ design phase that is now bonded for 5 years at an average taxpayer cost of $30/year.

Did you ever get an explanation for why there was a miscalculation (i.e., where was the error)?

ReplyDeleteAlex Grant